Ever been tempted by an offer like “0% financing for 12 months” on a shiny new appliance or a sleek car? It sounds like free money, doesn’t it? Zero-interest loans can be a fantastic tool when used wisely, but they come with a few strings you need to untangle first. Let’s grab a cup of coffee and dive into what these loans are, how they work, and what to watch out for.

What Are Zero Interest Loans?

At their core, zero-interest loans let you borrow money without paying any interest for a specified period. Instead of charging you for the privilege of borrowing, the lender offers a promotional period where interest rates are set to 0%.

For example, if you purchase a $1,200 appliance with a zero-interest loan over 12 months, you’ll pay exactly $100 per month—no extra costs, provided you stick to the terms.

Why Do They Matter?

In today’s economy, where borrowing costs are often high, zero-interest loans can make large purchases more manageable. They are particularly popular for financing cars, appliances, medical bills, or even home improvement projects.

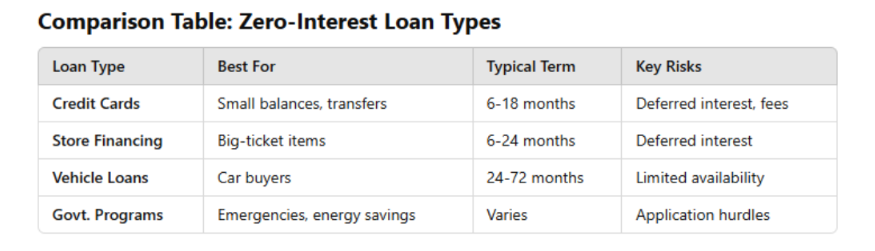

Types of Zero Interest Loans

1. Credit Card Promotions

- Many credit cards offer 0% APR (Annual Percentage Rate) for balance transfers or new purchases during an introductory period (e.g., 12-18 months).

- Example: Transfer $5,000 from a high-interest card to a 0% APR card and pay it off before the promotion ends.

Pro Tip: Watch out for balance transfer fees—typically 3-5% of the transferred amount.

2. Store Financing

- Retailers like furniture or electronics stores often offer zero-interest financing for big-ticket items.

- Example: Buy a $2,000 TV with 0% financing for 24 months—$83.33 per month.

Warning: Miss a payment or fail to pay it off in time, and deferred interest (interest retroactively applied to the full amount) could kick in.

3. Vehicle Loans

- Automakers often provide zero-interest loans to qualified buyers to encourage car sales.

- Example: Instead of paying 5% interest on a $30,000 car loan, you could save thousands over five years with a 0% loan.

4. Government Programs

Zero-interest loans are sometimes offered for specific needs, like disaster relief, home improvement, or small business support.1

- Zero-interest loans are sometimes offered for specific needs, like disaster relief, home improvement, or small business support.

- Example: Some states offer 0% loans for energy-efficient upgrades to homes

Comparison Table: Zero-Interest Loan Types

The Good, The Bad, and The Sneaky

The Good

- Cost Savings: Borrow money without paying interest.

- Cash Flow Flexibility: Spread out payments over time without penalty.

- Improved Affordability: Makes large purchases manageable.

The Bad

- Strict Terms: Missing a payment can trigger high penalties.

- Short Timeframes: Promotions often last only 6-18 months.

- Credit Requirements: Usually reserved for those with excellent credit.

The Sneaky

- Deferred Interest: If you don’t pay the full amount by the end of the promotional period, interest is charged on the entire original balance, not just the remaining amount.

- Hidden Fees: Balance transfer fees, late fees, or application fees can catch you off guard.

Real Story:

A friend of mine financed a $3,000 couch with 0% interest over 24 months. She missed a single payment, and suddenly, $600 in interest was tacked on retroactively. Ouch.

Who Should Consider These Loans?

Ideal Candidates

- Have excellent credit (usually 700+).

- Can commit to paying off the loan within the promotional period.

- Need to make a large, planned purchase (not impulse buys).

Who Should Avoid Them?

- If you struggle to make regular payments or often forget deadlines.

- If your budget is already stretched thin.

Pro Tip: Set up automatic payments to avoid missing deadlines.

Smart Strategies for Success

Calculate Payments Beforehand

- Divide the loan amount by the promotional period to know your monthly payment.

- Example: A $1,200 loan over 12 months = $100/month.

Set Up Autopay

- Avoid missed payments by automating them.

Pay More Than the Minimum

- If possible, pay off the loan faster to reduce risk.

Create a Payoff Timeline

- Keep track of when your promotional period ends to avoid surprises.

Maintain an Emergency Fund

- Ensure you can meet payments even in unexpected situations.

Common Pitfalls and How to Avoid Them

Missed Payments

- Consequence: Penalties or the loss of the 0% rate.

- Solution: Set reminders or automate payments.

Deferred Interest

- Consequence: Retroactive interest on the full amount.

- Solution: Pay off the entire balance before the promotional period ends.

Overborrowing

- Consequence: Taking on more debt than you can handle.

- Solution: Borrow only what you can repay comfortably.

Warning: Don’t let the “free” interest lure you into unnecessary purchases.

Conclusion and Action Steps

Zero-interest loans can be a powerful tool when used correctly. They let you borrow money without the usual cost of interest, making large purchases easier to manage. However, they come with strict rules and potential traps, like deferred interest or hidden fees.

Key Takeaways:

- Only borrow what you can afford to repay within the promotional period.

- Set up autopay and track deadlines carefully.

- Always read the fine print to avoid surprises.

Next Steps:

- If you’re considering a zero-interest loan, start by reviewing your credit score.

- Research lenders or credit cards that offer the best terms.

- Use an online loan calculator to plan your payments.

Question for You:

What purchase are you considering financing with a zero-interest loan? Let me know—I’d love to help you weigh the pros and cons!